Lose at Least 20 lbs. in

6 Weeks GUARANTEED

on Dr. Vactor’s Program!

Lose at Least 20 lbs. in

6 Weeks GUARANTEED

on Dr. Vactor’s Program!

Call Dr. Michael Vactor TODAY at (724) 742-2700 to get the weight off and keep it off – don’t wait until the end of Spring and miss the hot, summer fun! Instead, CALL TODAY!

EXERCISE is OPTIONAL. The focus of Dr. Vactor’s weight loss program is getting the pounds off first. This way exercise programs will not contribute to the risk of injury, joint pain or over-exertion from carrying too much weight. A trimmer you will be much more energetic and capable of joining in your favorite summer activities.

Dr. Vactor’s innovative weight loss program focuses on shedding the pounds and keeping it off through a safe, healthy system that is made up of ALL-NATURAL INGREDIENTS with NO STIMULANTS. Unlike other programs that you may have tried, this program focuses on weight loss first; then, helps you to readjust to the thinner you.

Here are just a few of the overall benefits of Dr. Michael Vactor’s LIFE-CHANGING Program:

SAFE, FAST, EASY AND EFFECTIVE NATURAL

WEIGHT LOSS

• Lose at least 1/2 pound per day, during

first cycle

• NO cravings, NO hunger pains, NO

pre-packaged foods

• Helps burn fat while you sleep, raises your metabolism

• Learn life style tools to keep it off

• This program targets belly, bum, hips, thighs

• GUARANTEED RESULTS

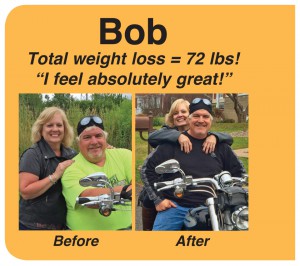

According to Dr. Vactor, “People who follow my program as outlined get great results! Our average patient loses at least half a pound per day per cycle! To date, 90-95% of my patients have achieved their weight loss goals.”

Dr. Vactor is so absolutely sure of the results and outcomes of his program, that he offers a GUARANTEE of RESULTS!

Who is Dr. Michael Vactor, DC? Dr. Michael Vactor is a doctor of chiropractic, and a natural healthcare advocate in the north Pittsburgh area for eighteen years. He is also an award winning expert in weight loss management and is frequently featured on KDKA-TV, WPXI, Cornerstone-TV, radio shows and other public speaking venues on health and weight-loss issues. In addition, Dr. Vactor cares for players, coaches and family members of our Black and Gold teams in Pittsburgh.

During this time, Dr. Vactor and his family have lived in the Cranberry and Mars area, where he is also devoted to his community and helping his patients reach their goals. With eighteen years in this community, he would not and could not make any such guarantee claims for weight loss, if they weren’t true.

How to Get Started: If you are committed to losing the weight now and be slim and trim in 6 weeks time, call for a FREE, in-office review of this life-changing weight loss system.

Call now, at

(724) 742-2700

If you can’t call now, take a picture of the number with your SMART phone so you have the number ready to call.

If you are one of the first 25 callers to schedule your no cost/no obligation consultation and in office review, and mention that you saw Dr. Vactor in the April 2018 issue of Northern Connection, you will receive a $50 discount good towards any of his guaranteed weight loss programs. Since losing weight is easier with a partner, we offer a double discount, $100 off per person, if you bring your spouse or significant other with you, and sign up together for our program, during your office consultation. Participants must both be present at time of program sign-up to receive the double discount. Not valid with any other offers and new patients only

are eligible.

Dr. Vactor’s office is conveniently located at 673 Castle Creek Drive, Ext. Suite 106 Seven Fields, PA 16046. Http://www.drvactor.com (724) 742-2700. n

Winter 2017/2018 Cover Story

Your Own Retirement: Take Charge of Your Life

By Janice Lane Palko

“Heading into retirement is a far different pathway than typical financial planning we have all come to know” said Susan Hickey, RICP® financial professional at Your Own Retirement. She and business partner David Hickey, CPCU® Managing Director, know because they have witnessed the challenges now faced by baby boomers first hand.

“We were in the business ourselves, and no one was talking about anything other than investment returns. It became very apparent there was a huge need for a laser focus practice specifically for those people not uber-wealthy.” Dave stated rather emphatically. “Investment decisions should be based on client goals and needs only, not what the herd or advisors believe to be most in vogue” added Susan. “And the other four areas of retirement planning need to be addressed first.”

Arriving at this point in their professional lives has been a work-in-progress that both Sue and Dave will readily admit. When Sue was 18, she was on her own working full-time to put herself through college. She worked in the insurance industry and then became a flight attendant, fulfilling a childhood dream. Dave and Sue married in 1986 and started a family two years later. After she had three of their five children, Sue surrendered her successful career to raise her family. “I chose to be home, which took some planning along with purposeful choices” Sue related. It was the beginning of balance between work, money, and time she now illustrates for clients daily.

In 1994, Dave was holding down a cushy six-figure job in downtown Pittsburgh but knew he couldn’t, in good conscience, continue to promote certain initiatives and ultimately left his job. “I started from scratch in the basement of a borrowed house,” he said.

Dave credits his mentors, role models, and friends for the inspiration needed to take on a new career path. “In retrospect, we had three young children and little money in the bank. But we came from poor so we figured we could do that all day long. In the end it was a price we were willing to pay to pursue a dream” Dave says. In particular, he credits former Pirate Sid Bream and Penguins legend Mario Lemieux. “I was so fortunate over those next many years to coach baseball with Sid and hockey with Mario. Both are true gentlemen and ethical to a fault, if that is even possible,” said Dave. “They gave me a whole different look at the world. Not just the celebrity and hero status they had, but the way they conducted themselves in the face of immense pressure to succeed athletically and professionally. Frankly, it made my situation look small in comparison and highly manageable” he adds. “We are still inspired to do the right thing, which is always the best reward,” added Sue.

While they both knew they were taking a risk in leaving lucrative careers, they also knew that they wanted more from their lives than merely collecting a paycheck. They wanted to do the right thing for themselves and for others and that meant taking their experiences and using them to help others. Sue recognized that there were many couples and individuals like them who would be facing retirement planning alone and largely without a pension for economic support. So, she attained her life and health insurance license, and then went on to achieve the Retirement Income Certified Professional (RICP®) designation which focuses on retirement income planning specifically. Dave’s risky career change proved to be a fruitful one as well. “Twenty-seven years later, Your Own Retirement has trained 22 other financial professionals across the country in our unique technique, as well as establishing our primary practice here in Cranberry,” Dave said. “We are fortunate to represent folks from all over the country, and our main focus is informing our neighbors to the need for a retirement professional now. I am very concerned about what will happen when the market corrects or worse” David said.

For the past 10 years, Your Own Retirement has narrowed its focus to these primary areas of retirement planning: income, health care, tax and legacy. “Traditional financial planning only addresses investment–accumulating wealth for retirement. We decided we wanted to concentrate on what happens before and after you retire—how to make your money last and create the kind of life you want in retirement,” Dave and Sue said.

You can have a large nest egg, but if you don’t have a plan to make it last, even the largest of nest eggs can be depleted. To ensure that never happens, Sue and Dave craft a written retirement plan that takes into consideration income, investments, social security, your home and other assets, Medicare, life insurance, and health care. “If you have a written plan in place, you can prepare for every eventuality. When the market drops or if there is a change in lifestyle, you will be ready,” they both said. Dave and Sue do not want to see their clients having to return to work after retiring for lack of a sustainable plan. “I have seen enough statistics to know that half do not have enough saved and another 2008 crisis could force a significant number of retirees back into the workplace” Dave lamented.

It can be overwhelming to think about mapping out decades in retirement, but Sue and Dave have created a process to help reduce the stress of retirement with their “Retirement Pathway 360.” The first step is simple—it’s meeting with Sue and Dave. “Our goal is to get to know you and your financial state,” said Dave. “This initial visit is where we get to know what it is you want and dream about for your individual retirement. At the second meeting, we identify the problems and gaps that need addressed. We then discuss ways to best work toward your retirement goals and make decisions on how to help you achieve them,” Sue said.

But Sue and Dave’s guidance doesn’t end there. “A retirement plan is flexible and ongoing,” said Dave. “We meet twice yearly, at least, to make any necessary adjustments. We walk beside you the whole way into and through retirement–all the way.”

Many of their clients are couples, but recently Your Own Retirement has identified a need for women to better prepare for their futures. “Women present a unique set of circumstances when it comes to their retirement years. Longevity is a major factor. Many women live three decades in retirement and are surviving into their nineties. Women may outlive their spouse, which has the potential to impact their income significantly. You must plan for the potential loss of Social Security benefits or pensions.,” said Sue.

Another factor is that many women leave retirement planning to their husband. “Women need to be aware of their financial situation and consider what could happen if their spouse dies. They need to know where all the important papers are kept, what their investments are, etc. They also need to think about important questions such as: Who will take care of me? Will I be able to afford to stay in my house? What if I get sick and need to move? Questions that we as woman don’t look at as we are too busy taking care of everyone else,” said Sue.

“We emphasize a ‘Lifestyle Plan’ for retirement,” said Sue, “one that addresses all aspects such as health care costs and long-term care. It may seem overwhelming, but even making small changes now in your retirement plan and health habits may increase the chance for you to be able to live the way you want and deserve in retirement.”

In addition to their highly popular retirement seminars, Your Own Retirement will soon be counseling small businesses whose employees are approaching retirement. Dave’s highly anticipated first book Don’t Be Stupid: Lessons Learned From My Father will be released in 2018. Your Own Retirement’s office is located in Cranberry Twp. but offers services to people in Western Pennsylvania and in many states all over the U.S. “Eighty percent of our clients are located here in Western Pennsylvania, but we have many around the country,” said David.

To learn more about how Your Own Retirement’s Pathway 360 written plan for retirement or to attend an upcoming seminar, visit their website at: www.yourownretirment.com or give Sue or Dave a call at: 1-866-677-PLAN (7526).

David Hickey offers investment advisory services through AE Wealth Management, LLC (AEWM). AEWM and Your Own Retirement are not affiliated companies.

We are an independent firm helping individuals create retirement strategies using a variety of insurance and investment products to custom suit their needs and objectives. This material is intended to provide general information to help you understand basic financial planning strategies and should not be construed as financial advice.

The information contained in this material is believed to be reliable, but accuracy and completeness cannot be guaranteed; it is not intended to be used as the sole basis for financial decisions. If you are unable to access any of the news articles and sources through the links provided in this text, please contact us to request a copy of the desired reference.

Fall 2017:

Celebrating Senior Champions

Creating a Better Life for Seniors

Rick Sebak, creator of memorable television programs that celebrate quirky aspects of modern American life, will serve as master of ceremonies when UPMC Senior Services honors extraordinary individuals and organizations who contribute significant time and energy to improving the lives of seniors throughout Western Pennsylvania.

To celebrate and support the UPMC Senior Communities Benevolent Care Fund, more than 400 business leaders, physicians and supporters of senior causes will gather on Thursday, October 19 for the Ninth Annual Celebrating Senior Champions Dinner and Auction at the Omni William Penn Hotel.

“We are proud to shine a light on three distinguished awardees whose extraordinary and diligent work benefits countless seniors and caregivers in our region. We are a stronger, healthier community for their contributions to the cause of aging well,” says Deborah Brodine, President of UPMC Community Provider Services.

Arthur S. Levine, MD will be honored as the Grand Champion. Dr. Levine became Senior Vice Chancellor for the Health Sciences and Dean of the School of Medicine at the University of Pittsburgh in 1998. He was named the John and Gertrude Petersen Dean of Medicine in 2013. He is also Professor of Medicine and Molecular Genetics in the School of Medicine.

The faculty of the University of Pittsburgh ranks fifth nationally in National Institute of Health (NIH) research funding, and Dr. Levine has been instrumental in fostering the University’s remarkable research trajectory. He is a driving force of fundamental research into aging processes at the cellular and subcellular levels. With respect to education, Dr. Levine has initiated new mechanisms designed to enhance the recruitment and retention of talented students and trainees with the goal of helping to reverse the precipitous decline across the nation in the numbers of young physicians and other health science students embarking upon substantive careers in research and education. He continues to have a marked influence upon growing the next generations of scientists and clinicians in geriatrics and gerontology.

Beyond his University responsibilities, Dr. Levine works closely with the University of Pittsburgh Medical Center, one of the largest academic medical centers in the U.S., to ensure that health care delivery, biomedical research, and education—the three legs of the “classic academic stool” – remain equally strong and well positioned for future growth. Dr. Charles F. Reynolds, Immediate Past Director of the Aging Institute, notes that his “leadership has proven to be wise and nimble in helping the Schools of the Health Sciences adapt to a rapidly changing environment. There are few, if any, institutions stronger than the University of Pittsburgh and the Medical Center in geriatrics and gerontology.”

The Jewish Healthcare Foundation (JHF) will be recognized as the Community Champion. Under the leadership of Karen Wolk Feinstein, PhD, President and CEO, JHF and its two operating arms, the Pittsburgh Regional Health Initiative (PRHI) and Health Careers Futures (HCF), perform a unique mix of grant making, research, teaching, coaching, and project management. Together, these entities have become a leading voice in patient safety, healthcare quality, and related workforce issues. “Having an organization that is laser focused on ensuring patient interests are addressed with dignity and the right to make decisions is a profound gift to a senior population that often reaches advanced years in a position of vulnerability,” says Darryl Ford Williams, Vice President of Content for WQED Multimedia.

As JHF’s founding leader, Dr. Feinstein takes pride in the integrated continuum of services and first-rate facilities that JHF funded and helped create through a $35 million commitment to the Jewish Association on Aging (JAA). She helped bring lean quality improvement techniques to health care, extending JHF’s capacity in training and coaching in these methods to skilled nursing facilities throughout Pennsylvania. JHF staff has also supported these facilities in successful efforts to reduce avoidable hospitalizations among nursing home residents.

Dr. Feinstein’s personal mission to improve end-of-life care has resulted in national programming, recognition, and consultation (under an umbrella named Closure), as well as important local conversations and a unique fellowship. Under her leadership, JHF has funded research proposals to combat hospital-induced delirium among seniors, balance and coordination issues, depression in nursing homes, isolation, and caregiving. JHF’s own research efforts have explored recurring hospital admissions, and addiction and behavioral health problems among seniors. In 2016, JHF launched Senior Connections, an initiative to strengthen senior services related to transportation and housing, exercise and recreation, geriatric‐friendly primary care, and nutrition.

Eric G. Rodriguez, MD is our 2017 Caregiver Champion. Dr. Rodriguez is an Associate Professor of Medicine within the University of Pittsburgh’s Division of Geriatrics and serves as a geriatrics medical consultant at the UPMC Senior Care-Benedum Geriatric Center at UPMC Montefiore Hospital. Additionally, he is the Medical Director for UPMC’s Living at Home and Staying At Home programs which support seniors in their desire to age in place.

Named a Pittsburgh Magazine “Top Doctor” and among the “Best Doctors in America” by Best Doctors, Inc., Dr. Rodriguez has been an internal medicine physician specializing in geriatrics for more than 30 years. His primary expertise is in the care of patients with complex, interacting comorbidity and polypharmacy, especially those suffering from dementia. Says Missy Sovak, Director of UPMC’s Geriatric Care Coordination Program, and a long-time colleague, “His devotion to all of his patients is evident in his daily practice, as we have heard repeatedly from our clients throughout the years. His extensive knowledge of geriatric syndromes and medications is invaluable to our program.”

Dr. Rodriguez participates in research in Alzheimer’s Disease with the University of Pittsburgh Alzheimer’s Disease Research Center. He has published many articles and abstracts on cognitive decline, evaluation and treatment of chronic low back pain in older adults, assessing fall risk when the patient’s cognition is impaired, and discrepancies in information provided to the primary care providers by patients with dementia. Additionally, Dr. Rodriguez mentors staff and students from all disciplines to enhance their expertise and to support the development of future geriatric practitioners. He is much sought after as a lecturer throughout the University of Pittsburgh Schools of Health Sciences.

All proceeds from the Celebrating Senior Champions Dinner and Auction will benefit UPMC Senior Communities Benevolent Care Fund, which provides financial assistance and support services to eligible seniors.

For more information about the event, contact Debra Panei, Director of Development for UPMC Senior Services, at 412-864-3524 or PaneiD@upmc.edu.

Peripheral Neuropathy Sufferers Have HOPE

Are you being told, “There’s nothing to be done?” or that, ”You need to learn to live with the pain?”

Peripheral Neuropathy Sufferers can be Pain-Free and Active Again!! Don’t Give Up!!

Approximately 20 million Americans suffer from this debilitating disease. They are suffering from symptoms of painful cramping, horrible pain sensations of burning and constant needling, difficulty walking, numbness and consequently, the interruption or inability to stay asleep.

Yet, sufferers are being told, “There’s nothing that can be done” or that, “You have to live with the pain.” Many sufferers are being over-medicated with pain medicines that don’t cure and run the risk of severe side effects and/or addiction.

Over the years, Dr. Shawn Richey’s program has a 91 percent satisfaction rate if patients are diagnosed correctly with true peripheral neuropathy.

How?

Through a specialized treatment protocol that is available through Dr. Richey’s practice at the Chiropractic Family Health Center. This program is designed to heal neuropathy rather than just deal with the symptoms.

“At first, I was skeptical,” admits Dr. Richey, “so when a patient comes to me for help and is just as skeptical as I was, I completely understand and agree. That’s why I give the first initial consultation and treatment for free and then offer a 6 visit trial run to make sure they start feeling changes.”

“This is not how I started out,” Dr. Richey explains, “I graduated from Logan College of Chiropractic with a Doctorate of Chiropractic Degree and a Bachelor of Science in Human Biology because I knew I wanted to help people and help people suffering with pain to feel better. I still practice chiropractic but when this treatment was first introduced to me, I had some serious doubts. But no more, after witnessing the incredible, healing results that I see every day and hear from patients, I am in a continual loop of inspiration and determination.”

“The thing I find most staggering,” shares Dr. Richey, “is how many people are suffering from peripheral neuropathy and the fact that nothing has been done about it before. Since 2013, I have seen over 1000 patients and learning of their devastating stories and life stealing symptoms has opened my eyes to the severity of this disease. Then to see the patients’ reactions, their joy in the diminished pain, their delight in getting their lives back is so rewarding. To see Mary dance into my office after just one treatment (hence MaryDancedIn.com) just makes my days great.

Once thought to be incurable, peripheral neuropathy occurs when nerves are damaged or destroyed and can’t send messages to the muscles, skin and other parts of the body. Peripheral nerves go from the brain and spinal cord to the arms, hands, legs and feet. When damage to the nerves takes place, numbness and pain in these areas may occur. Unlike laser therapy that does not address the involved damaged small nerve fibers or home light therapies that do not offer all the frequencies needed to heal them, our program utilizes state of the art technology with combined therapies to restore life to the dead nerves.

Dr. Shawn Richey has helped over a thousand patients suffering with peripheral neuropathy throughout the region. He has treated patients that have tried everything including potentially harmful medications and other painful testing and treatments. These can leave patients still struggling and wondering down the long road of endless disappointment. Now, he is able to address the pain associated with peripheral neuropathy with a successful, non-invasive, drug-free approach that includes the use of light therapy to stimulate tissue repair.

Chiropractic Family Health Center now has offices in both Sewickley at 2591 Wexford-Bayne Road, Suite 207 and Latrobe at 1901 Ligonier Street. For a FREE Consultation contact Dr. Shawn Richey at (724) 940-9000 and your appointment will be made at the location that is most convenient for you. To learn more, visit www.backnline.com.

FEATURED ON THE COVER OF THE SUMMER 2017 ISSUE OF PITTSBURGH FIFTY FIVE PLUS MAGAZINE.

REGARDLESS of AGE, you can slim down and look your best, with

REGARDLESS of AGE, you can slim down and look your best, with

Dr. Vactor’s Innovative Weight Loss Program!

Do you think you’re stuck? That even if you want to lose weight, you can’t because of your age? Do you want to have a fun and fulfilling retirement?

Call Dr. Michael Vactor TODAY at (724) 742-2700 to get the weight off and keep it off – the time to start your future is TODAY!

Dr. Vactor’s innovative weight loss program focuses on shedding the pounds and keeping it off through a safe, healthy system that is made up of ALL-NATURAL INGREDIENTS with NO STIMULANTS. Unlike other programs that you may have experienced, this program focuses first on weight loss, then helping you to readjust to the thinner you.

It is very important to note that EXCERCISE is NOT required. Instead, the focus, is getting the pounds off first, this way exercise programs will not contribute to the risk of, injury, joint pain or over-exertion from carrying too much weight.

It is very important to note that EXCERCISE is NOT required. Instead, the focus, is getting the pounds off first, this way exercise programs will not contribute to the risk of, injury, joint pain or over-exertion from carrying too much weight.

In addition, this program has consistent, predictable weight loss results where people also see a dramatic improvement in their overall HEALTH in about a month’s time.

According to Dr. Vactor, “I have seen cholesterol numbers, blood pressure and blood sugar levels return to normal in 30 days. People who follow our program as outlined get great results! Our average patient loses at least half a pound per day!”

To date, 90-95% of his patients have achieved their weight loss goals. YES, 90-95% of patients have achieved their weight loss goals REGARDLESS OF AGE. Dr. Vactor is so absolutely sure of the results and outcomes of his program, that he offers a GUARANTEE of RESULTS!

Who is Dr. Michael Vactor, DC? Dr. Michael Vactor is a doctor of chiropractic, and a natural  healthcare advocate in the north Pittsburgh area for over sixteen years. He is also an award winning expert in weight loss management and is frequently featured on KDKA-TV, WPXI, Cornerstone-TV, radio shows and other public speaking venues on health and weight-loss issues. In addition, Dr. Vactor cares for

healthcare advocate in the north Pittsburgh area for over sixteen years. He is also an award winning expert in weight loss management and is frequently featured on KDKA-TV, WPXI, Cornerstone-TV, radio shows and other public speaking venues on health and weight-loss issues. In addition, Dr. Vactor cares for

players, coaches and family members of our Black and Gold teams in Pittsburgh.

During this time, Dr. Vactor and his family have lived in the Cranberry and Mars area, where he is also devoted to his community and helping his patients reach their goals. With over seventeen years in this community, he would not and could not make any such guarantee claims for weight loss, if they weren’t true.

How to Get Started: If you are committed to losing the weight now; before you get any older, and improving your overall health in about a month’s time, call for a FREE, in-office review of this revolutionary weight loss system. Dr. Vactor’s office is conveniently located at 673 Castle Creek Drive, Ext. Suite 106 Seven Fields, PA 16046. Http://www.drvactor.com

Improve your health today! Call now, at (724) 742-2700.

If you can’t call now, take a picture of the number with your SMART phone so you have the number ready to call.

If you are one of the first 25 callers to schedule your no cost/no obligation consultation and in office review, and mention you saw Dr. Vactor on the cover of the Pittsburgh’s Fifty-Five Plus Spring issue, you will receive a $50 discount good towards any of his guaranteed weight loss programs. Not valid with any other offers and new patients only are eligible.

Results may vary based on an individual’s physical health, diet, personal commitment, and

adherence to the program. Information provided is not intended to diagnose, treat, cure, or prevent disease. Guarantee can be reviewed in the office prior to starting the program. Before starting any weight loss program, consult with a healthcare professional.

“The No. 1 fear people have heading into retirement is running out of money,” said Susan Hickey, Senior Advisor at Your Own Retirement, LLC.

Winter 2017 Cover Story – YourOwn Retirement

By Janice Lane Palko

“The No. 1 fear people have heading into retirement is running out of money,” said Susan Hickey, Senior Advisor at Your Own Retirement, LLC. Together, she and her husband David Hickey, Managing Director at Your Own Retirement, can help to replace that fear with peace of mind.

Unlike other financial advisory firms, Your Own Retirement takes a holistic approach to retirement, creating written retirement plans. “We are not just advisors on money and investments, but retirement advisors, which is all encompassing and takes into consideration income, investments, social security your home, other assets, Medicare, health care, and life insurance,” said Dave, who has more than 30 years’ experience in the insurance and finance industry.

“Earlier generations, like our parents, had pensions. But as Baby Boomers we have to save on our own with really no planning or educational help using old tools,” said Dave. “Often it’s a case of, ‘Here you go. You’re retired.’ And you don’t know what to do, how to make your money last, or how to make the life you want.”

To help you make the most of your investments and retirement, Sue and Dave craft a written retirement plan. According to Dave, an effective written retirement plan must meet four criteria. First, it must be very tax efficient. “We strive to make sure that our clients are saving as tax efficiently as possible.” Second, it must establish objectives. “Based on expenses and your desires for the future, we devise a map that prepares the way to achieve your objectives.” Third, Your Own Retirement strives to assess their clients understanding of and acceptance of risk. “We consult with our clients about how much risk they are willing to accept and still have their investments grow. Everyone’s tolerance is different,” Dave said. Finally, they devise a written downside protection plan. “We plan for the occasions when the market drops. Many people assume there’s nothing they can do when things take a downturn, but that is not true. We can strategize how best to weather those downturns,” Dave said.

To help you make the most of your investments and retirement, Sue and Dave craft a written retirement plan. According to Dave, an effective written retirement plan must meet four criteria. First, it must be very tax efficient. “We strive to make sure that our clients are saving as tax efficiently as possible.” Second, it must establish objectives. “Based on expenses and your desires for the future, we devise a map that prepares the way to achieve your objectives.” Third, Your Own Retirement strives to assess their clients understanding of and acceptance of risk. “We consult with our clients about how much risk they are willing to accept and still have their investments grow. Everyone’s tolerance is different,” Dave said. Finally, they devise a written downside protection plan. “We plan for the occasions when the market drops. Many people assume there’s nothing they can do when things take a downturn, but that is not true. We can strategize how best to weather those downturns,” Dave said.

Sue and Dave take into consideration each individual’s life situation, not only their finances. “Everyone’s life is different. Some have elderly parents, kids in college, some have physical disabilities,” said Sue, who is especially trained to help women plan for their retirement. “For single women, whether they are single by choice, divorce, or by being widowed, they are responsible for all of their retirement planning. Generally, women live a lot longer than men and run a greater risk of running out of money in retirement,” said Sue. Often times women don’t have a pension and sometimes their social security benefit is smaller, but Sue believes the sooner women take charge of their retirement, the better off they will be. “Women have to realize that no one is going do this for us. We have to be accountable and take responsibility for our own lives, but sadly, they don’t know who to turn to or where to go to get help,” she said. Your Own Retirement helps women to draft a written retirement plan so that you will never outlive your retirement funds.”

The goal of never outliving retirement funds is not only an objective for women but for all of their clients. Married couples need to plan for both partners in retirement. Statistics tell us that for an average married couple age 65, one of them–typically the woman–will live to be 92. People who don’t plan face the fear of running out of money and living in poverty or of depending on family members and possibly becoming a burden to them.

The first step to take to ensure that your retirement is everything you’d hoped it would be is to call Sue and Dave. They work together to assess the situation and make the best recommendations. “When we bring couples in, we often find that they haven’t really communicated well or shared what they expect with regards to their retirement,” said Dave.

“I’ve seen instances where the wife says something like, ‘my husband loves his job and plans to work until he’s 70,” said Sue, ‘and then the husband speaks up and says, ‘If I could retire tomorrow, I’d do it.’”

The old model for planning for retirement, often just involved a financial advisor who only wants to see your investment portfolio and manage your money. They may charge by the hour or a set fee. But Dave and Sue’s approach is different.

“For the initial meeting, there is no fee and it focuses on getting to know you, your financial well-being, your family situation. During the second meeting, we arrive at joint decisions on how to best achieve your retirement goals and whether we can work together.” said Dave.

Once your written retirement plan is in place, Dave and Sue don’t abandon you. “The retirement plan is fluid,” said Dave. “We meet at least yearly to tweak it if that is necessary. It’s not a one and done deal.”

“Situations change all the time,” said Sue. “People experience career changes, changes in family situation, health changes. If you have $10 million in the bank, you can weather those types of changes without it affecting your retirement. However, most people don’t have that amount of money saved, and we can help our clients adjust to whatever life throws at them to still achieve their retirement goals. It may take some compromises, or they may have to work harder, but we are there to help.”

Their clients appreciate what Your Own Retirement has done for them. “Clients have told us that after putting their retirement plan into place, they can go to sleep at night without worrying about what retirement may bring. They experience less stress,” said Dave.

“I always tell clients that I never want to be in the position of being in a grocery store and see them coming down the aisle and wanting to duck them because we’ve lost their money. We are not going to allow that,” said Dave.

People have been so pleased with what Sue and Dave have helped them to achieve that Your Own Retirement often receives referrals from clients. “We see client’s family members coming to us wanting us to help them create their own individual retirement plan too. We have worked with children after their parents have referred them.”

While their office is located in Cranberry Twp., Your Own Retirement offers services to people in Western Pennsylvania and all over the country. “Eighty percent of our clients are located in Western Pennsylvania, but we have dozens scattered throughout the country. We are happy to make house calls,” said Dave.

In addition, Your Own Retirement offers information and educational seminars throughout the year.

“Our passion in life is to help you achieve the retirement for which you have planned,” said Sue. “We want to give back to our community and help our neighbors live the retirement they dream.” n

Investment advisory services offered through AE Wealth Management, LLC, an SEC Registered Investment Adviser.

To learn more about how Your Own Retirement can help you construct a written plan for retirement, visit their website at: www.yourownretirement.com or give Sue or Dave a call at: 1-866-677-PLAN (7526) or 412-872-2151.

| Boomerang Young Adults and Financial Planning | |||||||

| By: Heather Murray | |||||||

|

|||||||

| Because older Americans are seeing an increase in expenses like healthcare and also tend to have more unsecured debt, retirement is often being delayed. Add to these costs an additional person living in what was a one or two person household, monthly cash flow could be affected. So, what do you do? It’s difficult for any parent to tell their child, I can’t help you, but it’s also important for parents to include their boomerang young adult in discussions on household finances. | |||||||

| One of the best ways to prepare young adult children for the reality of handling finances on their own is setting up a budget. Establishing a monthly budget can be a daunting task, but if done correctly, it serves as a valuable monthly spending guide. | |||||||

| Advantage Credit Counseling Service, Inc. is a nonprofit credit counseling agency headquartered in Pittsburgh. Operating since 1968, the Agency took its 40 plus years of experience and developed an online took that is extremely helpful in establishing a monthly budget. Online Budget Advisor, found at www.onlinebudgetadvisor.com, walks you through, step-by-step, on all things that should be considered when setting up a budget. The system asks you to take a thorough look at all living expenses, income and debt payments. It helps you detail exactly what you’re spending on a monthly basis. | |||||||

| After inputting your information, the system creates an action plan that is specific to the information you inputted. This action plan provides detailed money management suggestions that will help you better balance your budget and help you spend your money wisely. Going through this type of budgeting exercise will most likely be beneficial for you and your boomerang young adult. You both would gain a clear idea of how much money is needed for the household budget each month, it would help identify areas of responsibility for meeting these needs and it would help your young adult child better understand the reality of household expenses and the income necessary to meet them. | |||||||

| In addition to the budgeting tool, the online budget advisor system also includes a savings tracker, which allows users to establish savings goals and track their progress towards reaching these goals. Encouraging your young adult child to start saving for an apartment or to start building an emergency fund for when he or she is out on their own will bring them one step closer to financial stability and financial independence. |